puerto rico tax break

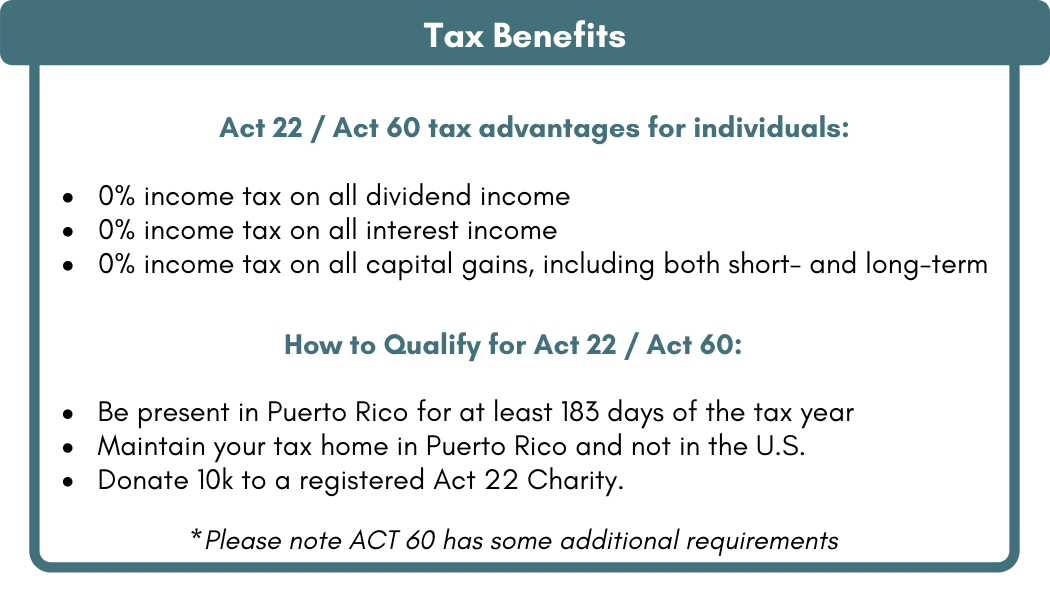

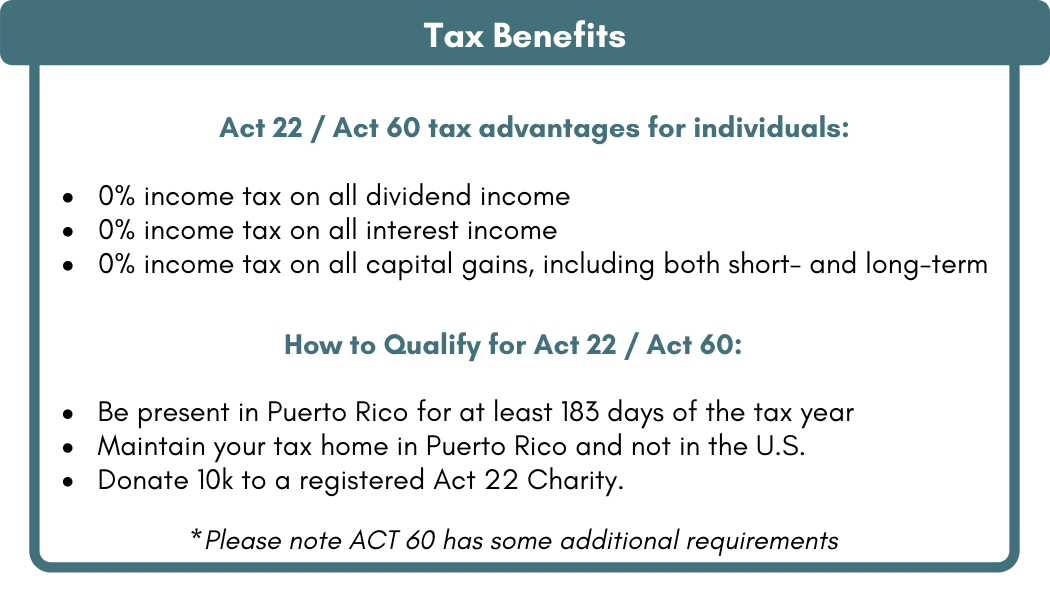

Act 22 is for individuals. Relative to the Made-In-America tax break the Made-in-Puerto Rico tax break has significant advantages.

Tax Breaks For Crypto Millionaires Stir Outrage In Puerto Rico As Housing Surges Bloomberg

The code organizes commonwealth laws.

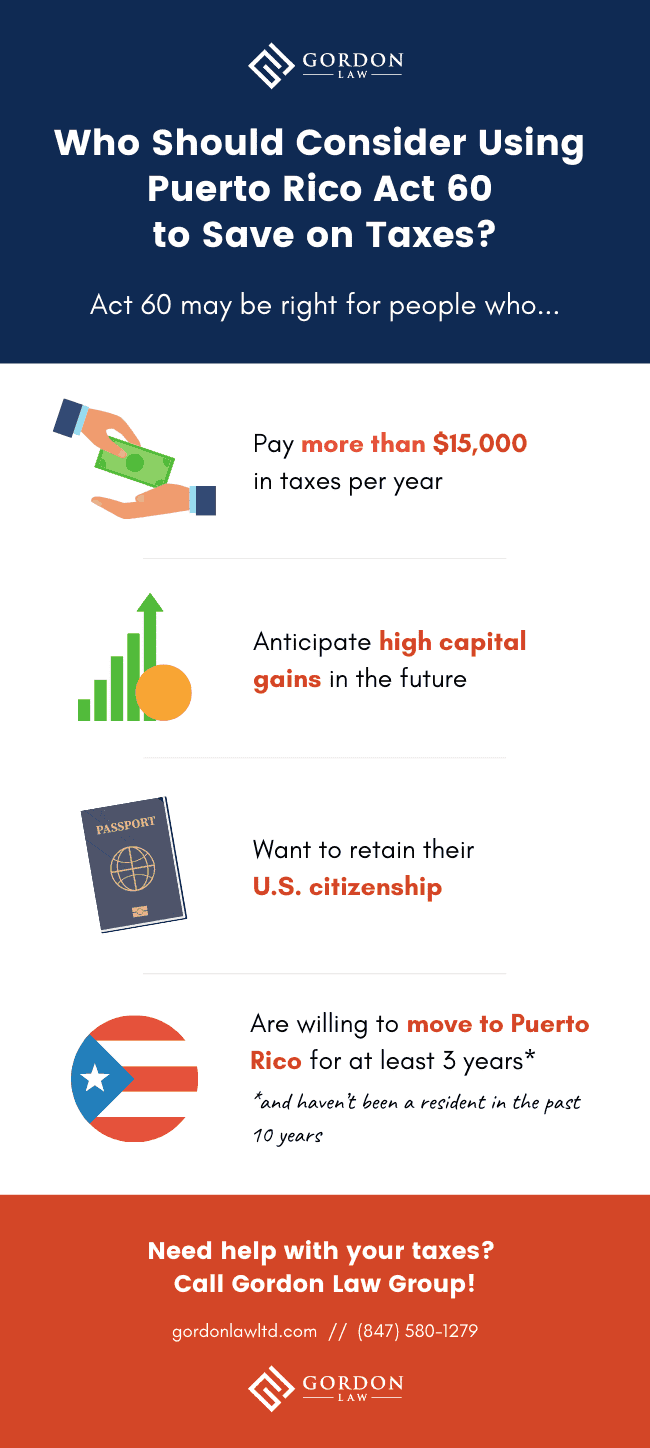

. Legally avoiding the 37 federal rate and the 133 California or other state rate is a jaw. The tax breaks fall under a law known as Act 60 a version of which was initially enacted by the Puerto Rico government under another name in 2012 as the island faced a. The Child Tax Credit is up to 3600 for each qualifying child for 2021 and up to 1500 for each qualifying child for 2022.

The tax breaks fall under a law known as Act 60 a version of which was initially enacted by the Puerto Rico government under. Also known as the Possession Tax Credit Section 936 was a provision in our tax code enacted in 1976 ostensibly to encourage business investment in Puerto Rico and other. Rodriguez for The New York Times.

Avoiding what he sees as unnecessarily high taxes in the Golden State in favor of Puerto Ricos considerable tax breaks. Theres also no capital gains tax. Take it from us obtaining a Puerto Rico tax break can be prolonged and frustrating.

2 days agoIn Puerto Rico cheap labor and generous tax breakssince 2017 more than 100 billion worthhave made US-based pharmaceutical firms the biggest economic players in. The tax break was. The main body of domestic statutory tax law in Puerto Rico is the Código de Rentas Internas de Puerto Rico Internal Revenue Code of Puerto Rico.

The tax break was implemented by a Puerto Rican politician who was dissatisfied with the state of life on the. But some residents fear tax. As a general rule you must give 4 of your income to Puerto Rico.

You have to move. One of the biggest breaks created by last years tax law sits in Puerto Rico a hurricane-ravaged island desperate for a recovery. It confers a 100 tax holiday on passive income and capital gains for 20 years.

If you move to the island you can legally pay none. It can also be quite expensive. Residents of Puerto Rico must file a federal tax return with the IRS to.

Still Puerto Rico hopes to lure American mainlanders with an income tax of only 4. During a recent appearance on Philip. Our founders business relocation utilized 3 different.

American YouTuber Logan Paul has accused Puerto Rican rapper Bad Bunny of taking advantage of his home countrys tax breaks. Paul is not alone. For years the wealthy have swarmed to Puerto Rico.

You just have to give 4 percent of your income to Puerto Rico. 1 the 4 corporate tax rate has existed for decades and lasts. The zero tax rate covers both short-term and long-term capital gains.

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

What Logan Paul S Move To Puerto Rico Means Beyond The Tax Breaks

Puerto Rico Promises Tax Breaks In Attempt To Lure Family Offices

A Global Americans Review Of Boom And Bust In Puerto Rico How Politics Destroyed An Economic Miracle

The Newest Caribbean Tax Haven Is Puerto Rico

Should Disaster Recovery For Puerto Rico Depend On Tax Payments Puerto Rico 51st

How Dependence On Corporate Tax Breaks Corroded Puerto Rico S Economy

Everything You Need To Know About Puerto Rico

Utah Founders Are Moving To Puerto Rico Utah Business

Puerto Rico S Allure As A Tax Haven

Could Moving To Puerto Rico Reduce Your Taxes Expensivity

Puerto Rico Tax Haven Is It An Offshore Jurisdiction

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Puerto Rico Tax Haven For Online Businesses Tax And Startup Law

An Unfulfilled Promise Colonialism Austerity And The Puerto Rican Debt Crisis Harvard Political Review

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

How Puerto Ricans Are Fighting Back Against Using The Island As A Tax Haven Time

Tax Policy Helped Create Puerto Rico S Fiscal Crisis Tax Foundation